Retirement Planning – Types Of Retirement Benefits Schemes (I)

By Musbahu El Yakub

By Musbahu El Yakub

Models of retirement benefit pension schemes continue to evolve over time and in different parts of the world for various reasons. To appreciate what the types and models of the schemes are, it is appropriate that we understand what are the issues that governments, regulators, and operators face.

The primary objectives of retirement benefits packages are:

To provide economic security in ‘old age’

To smoothen the distribution of consumption spending over the lifespan of individuals by shifting part from the more productive to the later years

To provide ‘insurance’ that covers life’s requirements for those with longevity beyond national average expectancy, etc.

The objectives might seem clear enough but achieving them comes with challenges. On one hand, if given the liberty, some individuals can plan their retirement fallback well while many others will either not do it at all or not do it successfully. Unfortunately, the consequences of not planning for retirement or not doing it well are costly to the person that failed and to their families and the nation. On the other hand, what the government does in terms of running the economy and pension regulations; the integrity of the systems and processes; and the competence and credibility of the individuals involved all come to bear on the short- and long-run successes of pension schemes. It is for these reasons that models must be thoughtfully conceptualized and developed leaving no relevant details unconsidered.

Both Augustus’ and von Bismarck’s pension schemes were public-sector initiated. The Legionnaires’ pensions were initially financed by regular taxes and later by a 5% inheritance tax in addition to the personal commitment made by Emperor Augustus. The beneficiaries were those who had served for twenty-five years (some say twenty) in the military. The payment to beneficiaries was a one-off lump sum of thirteen years’ salary. Participation in the retirement system of von Bismarck was compulsory and contributory, with deductions taken from the employee, employer, and the government. Unlike the Emperor’s scheme, this is tied to age, seventy, which was quite high for the life expectancy of the time. The Baltimore and Ohio Railroad plan in the US was private sector-initiated and jointly financed by contributions from employers and their employees.

Up to those points in history, the burgeoning and rolling future costs of pensions were not fully appreciated even though a ‘safe game’ was played. For instance, when Germany introduced their old-age and disability pensions, which could be assessed upon turning sixty, the average life expectancy of Germans was forty-five. So not many lived to draw on the benefits! But in 2021, the average life expectancy of Germans was 81.57 years and public spending on pensions amounted to 10.4% of its US$4.26 trillion GDP that year. With a gradually ageing population and an increasing dependency ratio, the OECD expects German public spending on pensions to grow to 12.5% of US$36.5 trillion GDP by 2060.

At home in Nigeria, there were about 9.9 million Retirement Savings Account holders by the end of February 2023. This was 8.2% of our working-age population and 14% of the labour force. The two ratios are lower than ILO global averages of 49.6% and 69.3% respectively. Regardless, the total assets under management of the regulated pension at the same time was N15.4 trillion, or 7.8% of 2022 GDP. Even though this is below the 29.4% average (2020) for a group of 78 countries based on World Bank data, the assets represent a reasonable slice of our GDP. But beyond whatever ratio to the GDP it is, N15.4 trillion represents the hard savings of 9.9 million real people (and their families) in anticipation of a financially secure future when they are likely to be less productive and more vulnerable.

The point is just that pension assets are massive and are expected to continue to grow. They need to be jealously protected and sensibly nurtured. Along the timeline, there will be risks and uncertainties, economic downturns, incompetence, etc. Consequently, to achieve the cardinal objective of providing old age security, many things must be done right and consistently over time:

Sufficient funds should be raised

The funds raised should be continuously invested to generate real positive returns

Operations in the industry are to be closely regulated and monitored

Payments to beneficiaries in the years ahead are to be made in full and as they fall due

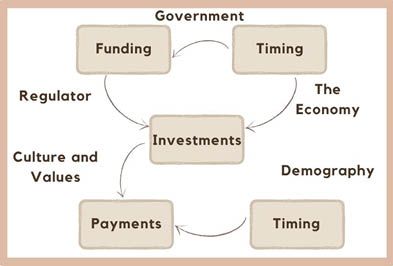

Below is a schematic of some of the factors at play in developing pension scheme models aimed at achieving the objectives mentioned.

Basic retirement plan modelling factors © Musbahu El Yakub 2023

A successful pension model would, therefore, need:

An effective government that manages the economy well to make pension asset growth possible

A credible and competent regulator that supervises the industry and ensures periodic updates taking emergent realities into cognisance

Professional and competent operators

Choice between variant funding systems

Take into full consideration economics, demographics, history, and culture, etc.

Pension types and models are critical to the success of pension schemes in meeting desired objectives. In return, models should be developed based on several factors, some of which are mentioned above. Next week, we will up a few pension types and models and the one we have adopted and adapted in our country.

Credit: Daily Trust